“A NEW carbon cop will be given sweeping powers to enter company premises, compel individuals to give self-incriminating evidence and copy sensitive records under a carbon tax package that will force about 60,000 businesses to pay 6c a litre extra for fuel.

“The tough new powers of the Clean Energy Regulator were included in the fine detail of the carbon tax package released yesterday, which enshrines national emissions cuts of 12 million tonnes of carbon dioxide a year after 2016, if the government of the day rejects targets proposed by its Climate Change Authority.

“The package, which shows that the government will cement in law the body of its carbon tax structure in a bid to force Tony Abbott to win the approval of both houses of parliament to complete his promise to scrap it, also tasks the Productivity Commission with inquiries into assistance to trade-exposed industries, international climate change action and the future of fuel taxes…

from The Australian

read more here: http://www.theaustralian.com.au/national-affairs/carbon-cop-handed-tough-new-powers/story-fn59niix-1226103778785

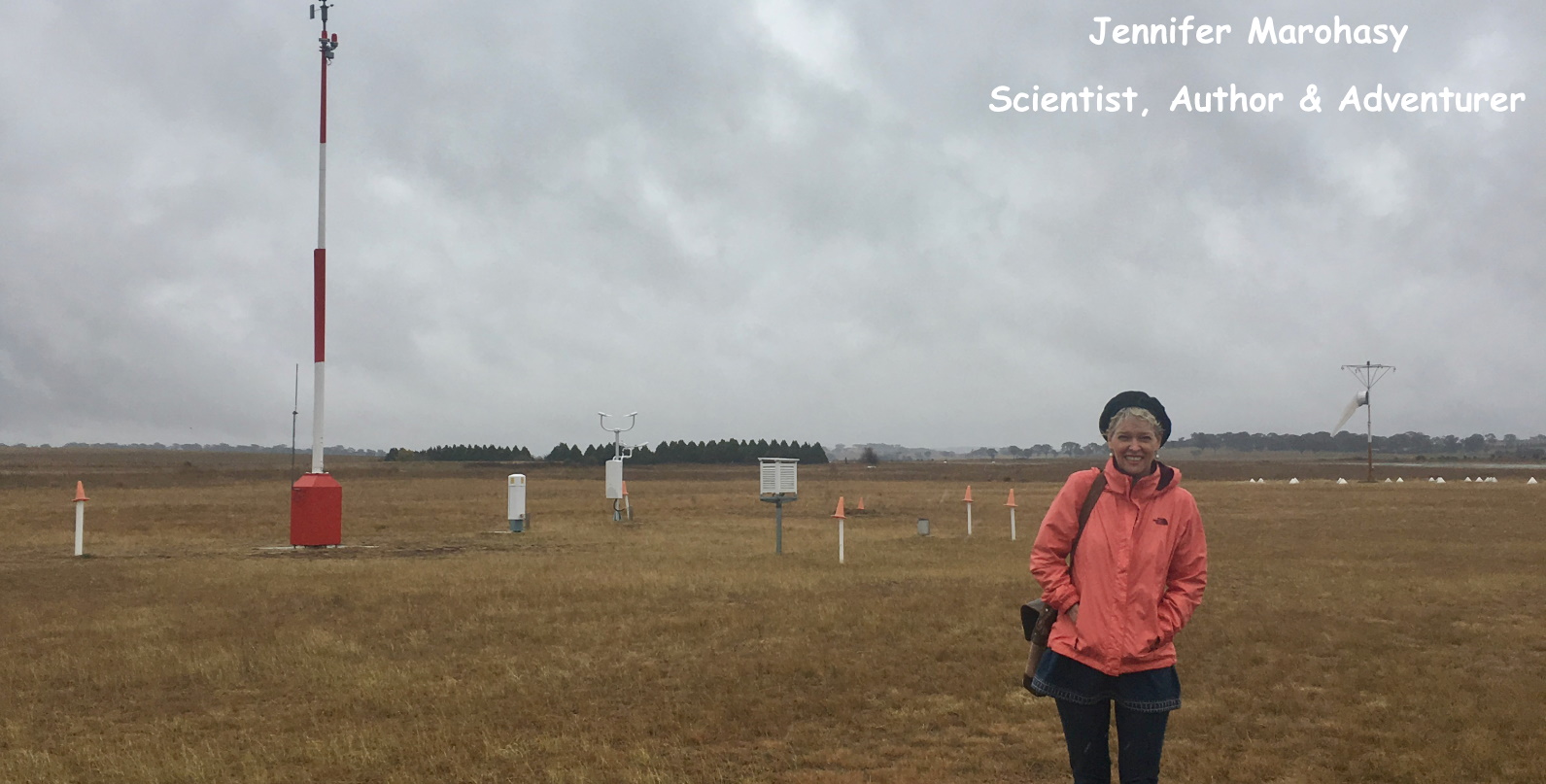

Jennifer Marohasy BSc PhD has worked in industry and government. She is currently researching a novel technique for long-range weather forecasting funded by the B. Macfie Family Foundation.

Jennifer Marohasy BSc PhD has worked in industry and government. She is currently researching a novel technique for long-range weather forecasting funded by the B. Macfie Family Foundation.