“While you were distracted by crashing banks and clashing US senators, you may have missed a small environmental earthquake. The price of carbon has collapsed.” Read more here.

Economics

Wishful Thinking on Carbon Trading

Last week the Australian Treasury released modelling of the likely impact of an Emissions Trading Scheme. All the scenarios assume the rest of the world will sign-up. Read more here.

Economic Growth & Carbon Trading

Bull Market in Environmental Guilt

“This is strange territory. The Dow is down. Wall Street needs a bailout. But in the Washington area and across the country, there is still a bull market in environmental guilt. Sales of carbon offsets — whose buyers pay hard cash to make amends for their sins against the climate — are up. Still. In some cases, the prices have actually been climbing. In other words, when nearly everything seems to be selling for less, thousands of individuals and businesses are paying more for nothing, or at least nothing tangible.” Read more here.

Key Australian Government Advisor Hands Down Final Report on Climate Change

The Australian Government’s climate change adviser, Professor Ross Garnaut, says a global agreement must be reached to successfully reduce the world’s carbon emissions and has urged action without delay. Indeed Professor Garnaut went so far as to suggest in a televised address that, “On a balance of probabilities, the failure of our generation on climate change mitigation would lead to consequences that would haunt humanity until the end of time.”

On the issue of the need for a worldwide response Professor Garnaut suggested:

1. An International Adaptation Assistance Commitment would provide new adaptation assistance to developing countries that join the mitigation effort

2. Early sectoral agreements would seek to ensure that the main trade-exposed, emissions-intensive industries face comparable carbon prices across the world, including metals and international civil aviation and shipping

3. A World Trade Organisation (WTO) agreement is required to support international mitigation agreements and to establish rules for trade measures against countries thought to be doing too little on mitigation

On the issue of an Australian emissions trading scheme, the Professor suggested:

1. The Establishment of an independent carbon bank with all the necessary powers to oversee the long-term stability of the scheme

2. Implementation of a transition period from 2010 to the conclusion of the Kyoto period (end 2012) involving fixed price permits

3. Credits to trade-exposed, emissions-intensive industries to address the failure of our trading partners to adopt similar policies

4. No permits to be freely allocated

5. Scheme coverage that is as broad as possible

Such a trading scheme would be very different to the European Model where I understand credits have been freely allocated and petrol, for example, is exempt.

Professor Garnaut has accepted the science of climate change as explained by the United Nation’s Intergovernmental Panel on Climate Change (IPCC) and sections of his earlier reports read like oversimplified versions of the IPCC reports.

Professor Garnaut is close to Australia’s Rudd Labor Government and this final report is likely to reflect Australian government thinking on this issue. The Australian Prime Minister, Kelvin Rudd, and his Climate Change Minister, Penny Wong, have both used climate change as a vehicle for self promotion nationally and internationally and are deeply committed to the idea of a climate crisis.

The Garnaut Climate Change Review was commissioned by Australia’s Commonwealth, state and territory governments to examine the impacts, challenges and opportunities of climate change for Australia. A Draft Report was released on 4 July 2008. The Supplementary Draft Report Targets and trajectories was released on 5 September 2008. The Final Report was released yesterday on 30 September 2008. All documents can be downloaded from the Garnaut Review website.

Financial Crash, Not Good for Concept of Carbon Trading

The proposed $700 billion bailout of Wall Street failed to pass the US Congress last night. Across the world disappointed investors are now fleeing stock markets as the global economy teeters on ruin.

With the likely arrival of more austere times it is unlikely national governments will have a lot of time or interest in environmental issues, including global warming.

The belief that Australia may be somehow immune from hardship because of our mineral wealth and proximity to China is likely to be challenged, along with the idea that we can forge ahead with an Emissions Trading Scheme. Indeed it is resource shares that have been most affected this morning.

During this period of intense market instability, it is likely to be increasingly difficult to justify any additional stresses to the economy particularly one based on the idea of trading a commodity, carbon, for which there is no real market.

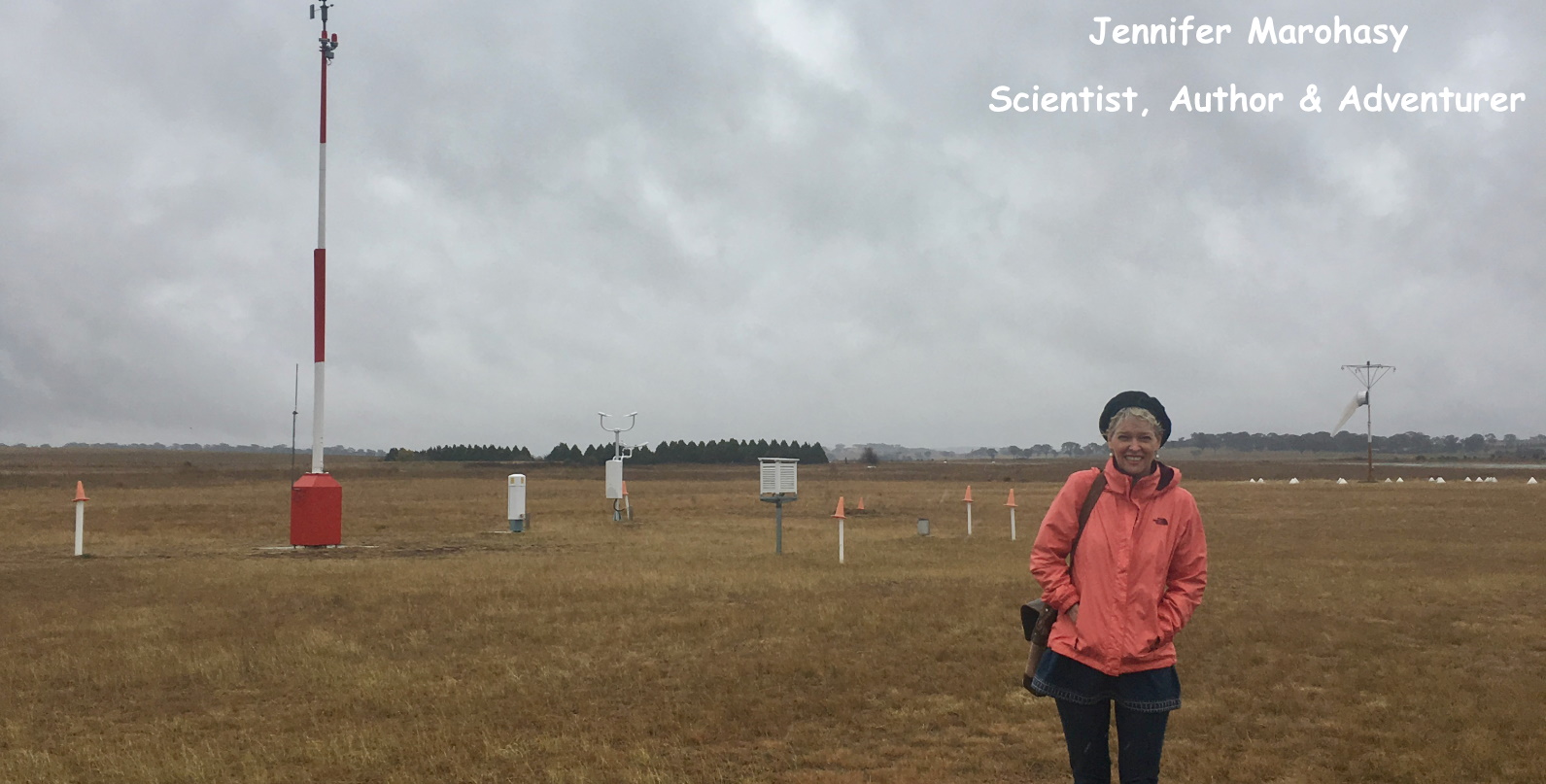

Jennifer Marohasy BSc PhD has worked in industry and government. She is currently researching a novel technique for long-range weather forecasting funded by the B. Macfie Family Foundation.

Jennifer Marohasy BSc PhD has worked in industry and government. She is currently researching a novel technique for long-range weather forecasting funded by the B. Macfie Family Foundation.